On 22 June 2020 Regulation (EU)2020/852 of the European Parliament and of the Council on the establishment of a framework to facilitate sustainable investment, and amending Regulation 2019/2088 on sustainability-related disclosures in the financial services sector (the "Taxonomy Regulation") has been published in the Official Journal of the European Union. It is a key piece of legislation that will contribute to the European Green Deal by boosting private sector investment in green and sustainable projects. The aim of the Taxonomy Regulation is to create the world's first-ever “green list” – a classification system for sustainable economic activities that will create a common language that investors can use everywhere when investing in projects and economic activities that have a substantial positive impact on the climate and the environment.

SUBJECT MATTER AND SCOPE

The Taxonomy Regulation establishes the criteria for determining whether an economic activity is environmentally sustainable for the purposes of establishing the degree of environmental sustainability of an investment. It applies to:

- measures adopted by the European Union or its member states (the "Member States”) placing any obligations on financial market participants or issuers with respect to financial products or corporate bonds that are made available as environmentally sustainable;

- financial market participants within the meaning of Article 2(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector (the "Disclosures Regulation" that make available financial products;

- undertakings which are subject to the obligation to publish a non-financial statement or a consolidated non-financial statement pursuant to Directive 2013/34/EU.

ENVIRONMENTALY SUSTAINABLE ECONOMIC ACTIVITIES LIST

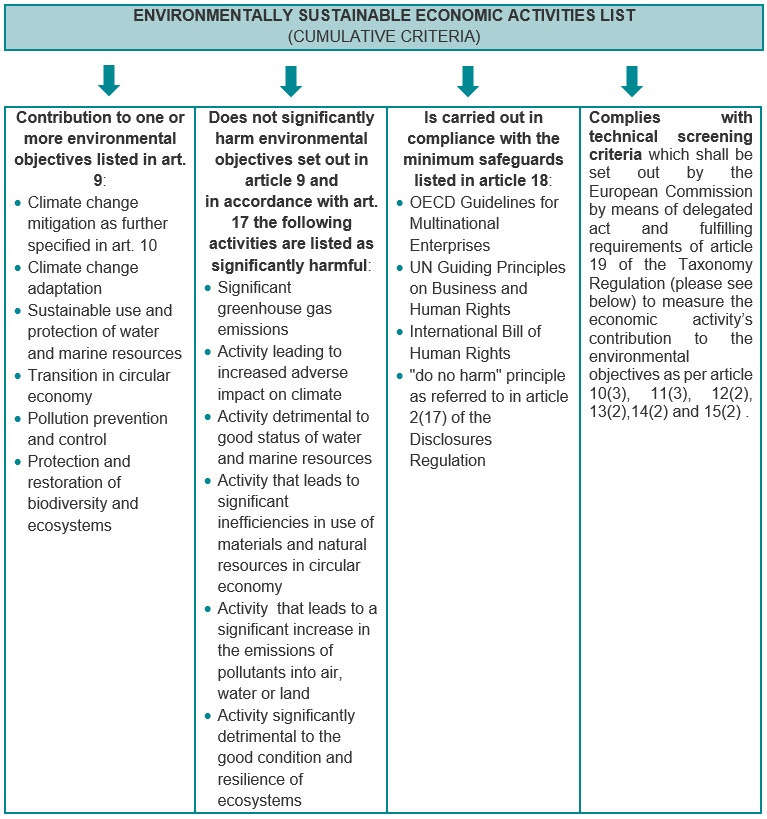

Article 3 of the Taxonomy Regulation introduces a list of the criteria which allow to qualify an economic activity as environmentally sustainable. The criteria are summarized in the table below:

CRITERIA FOR ENVIRONMENTALLY SUSTAINABLE ECONOMIC ACTIVITIES

Article 4 provides that Member States and the European Union, for the purpose of introducing public measures, standard setting or labels which are addressed to financial market participants or issuers in respect of financial products or corporate bonds, have to apply the criteria for environmentally sustainable economic activities (set out in the foregoing table) to determine whether an economic activity qualifies as environmentally sustainable

TRANSPARENCY OF ENVIRONMENTALLY SUSTAINABLE INVESTMENTSArticle 5 of the Taxonomy Regulation requires that in the cases where an objective of a financial product is sustainable investment, with or without an index designated as a reference benchmark, or reduction in carbon emissions, and such product contributes to environmental objectives, the information to be disclosed in accordance with article 6(3) and 11(2) of the Disclosures Regulation should include information on the environmental objective or environmental objectives to which the investment underlying the financial product contributes. Moreover, it should include a description of the extent to which the investments underlying the financial product are in economic activities that qualify as environmentally sustainable under article 3 of the Taxonomy Regulation (table above).

TRANSPARENCY OF FINANCIAL PRODUCTS THAT PROMOTE ENVIRONMENTAL CHARACTERISTICS

Article 6 provides that when a financial product promotes, among other characteristics, environmental or social characteristics, or a combination thereof within the meaning of article 8(1) of the Disclosures Regulation disclosures made under article 6(3) and 11(2) shall include a statement that: “the “do no significant harm” principle applies only to those investments underlying the financial product that take into account the EU criteria for environmentally sustainable economic activities.”

TRANSPARENCY OF UNDERTAKINGS IN NON FINANCIAL STATEMENTS

Pursuant to article 7, if a financial product is not subject to Article 8(1) or to Article 9(1), (2) or (3) of the Disclosures Regulation the information to be disclosed in accordance with the provisions of sectoral legislation referred to in Articles 6(3) and 11(2) of that Regulation shall be accompanied by a statement providing that the investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

TRANSPARENCY OF UNDERTAKINGS IN NON FINANCIAL STATEMENTS

Pursuant to article 8, undertakings which are subject to the obligation to publish non-financial information pursuant to Article 19a or Article 29a of Directive 2013/34/EU shall include in their non-financial statements or consolidated non-financial statements information on how and to what extent the undertaking’s activities are associated with economic activities that qualify as environmentally sustainable.

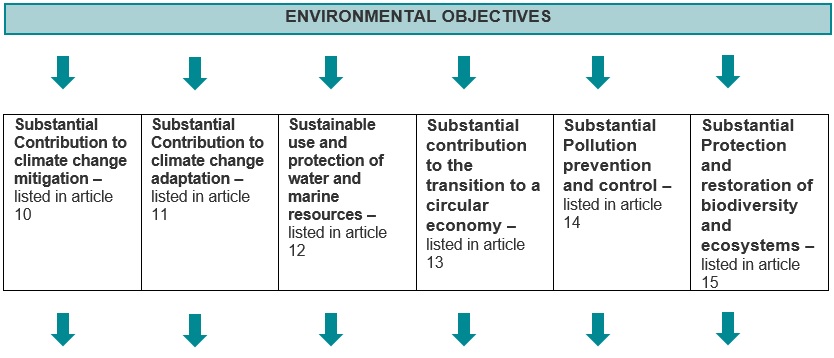

ENVIRONMENTAL OBJECTIVES

Articles 10 to 15 list examples of economic activities which contribute to the environmental objectives set out in article 9.

Contribution to climate change mitigation includes, among others, generating, transmitting, storing, distributing or using renewable energy, improving energy efficiency, except for power generation activities, increasing clean or climate-neutral mobility, switching to the use of sustainably sourced renewable materials, or producing clean and efficient fuels from renewable or carbon-neutral sources.

Contribution to climate change adaptation includes, among others, adaptation of solutions that substantially reduce the risk of the adverse impact of the economic activity on climate without increasing the risk of an adverse impact on people, nature or assets

Sustainable use and protection of water and marine resources includes, among others, protecting the environment from the adverse effects of urban and industrial waste water discharges, protecting human health from the adverse impact of any contamination of water intended for human consumption or ensuring the sustainable use of marine ecosystem services or contributing to the good environmental status of marine waters.

Transition to a circular economy includes, among others, increasing durability, reparability, upgradability or reusability of products, in particular in designing and manufacturing activities, reducing the content of hazardous substances and substitutes substances of very high concern in materials and products, prolonging the use of products or preventing or reducing waste generation.

Pollution prevention and control includes, among others, preventing or, where that is not practicable, reducing pollutant emissions into air, water or land, improving levels of air, improving water or soil quality in the areas in which the economic activity takes place or cleaning up litter and other pollution

Protection and restoration of biodiversity and ecosystems includes, among others, nature and biodiversity conservation, sustainable land use and management, including adequate protection of soil biodiversity, sustainable agricultural practices or sustainable forest management.

SIGNIFICANT HARM TO ENVIRONMENTAL OBJECTIVES

Article 17 provides clarification as to when an economic activity shall be considered to significantly harm an environmental objective (please refer to our table “Environmentally sustainable economic activities list” page1).TECHNICAL SCREENING CRITERIA (“TCS”)

The Taxonomy Regulation requires the European Commission to, by means of delegated act, adopt TCS. Article 19 provides that the TCS shall among others:

- identify the most relevant potential contributions to the given environmental objective;

- specify the minimum requirements that need to be met to avoid significant harm to any of the relevant environmental objectives;

- be quantitative and contain thresholds to the extent possible;

- be based on conclusive scientific evidence and the precautionary principle enshrined in Article 191 TFEU;

- where feasible, use sustainability indicators as referred to in Article 4(6) of the Disclosures Regulation

PLATFORM FOR SUSTAINABLE FINANCE

Article 20 provides that the European Commission shall establish a platform for Sustainable Finance (the “Platform”). It shall be composed of:

- the representatives of: (i) the European Environment Agency, (ii) the ESAs, (iii) the European Investment Bank and the European Investment Funds, (iv) the European Union Agency for Fundamental Righ;

- experts representing relevant private stakeholders;

- experts representing civil society;

- experts appointed in a personal capacity who have proven knowledge in matters covered by the Taxonomy Regulation;

- experts representing academia;

The Platform shall advise the European Commission on adoption of technical screening criteria (“TSC”), analyse their impact, assist the European Commission in analysing requests from stakeholders to develop or revise them and advise on their usability in practice. The Platform shall also advise the Commission on the possible need to develop further measures to improve sustainability related data, its availability and quality, the possible need to amend the Taxonomy Regulation as well as evaluation and development of sustainable policies and addressing other sustainability and social objectives.

AMENDMENTS TO DISCLOSURES REGULATIONArticle 25 lists amendments to the Disclosure Regulation. For more details please refer to a dedicated article – No 8 of BSP Sustainable Finance Insights Series.

MEASURES AND PENALTIES

Article 22 states that Member States shall lay down the rules on measures and penalties applicable to infringements of Article 5, 6 and 7 of the Taxonomy Regulation. These articles refer to the Disclosure Regulation and guarantee the disclosure and transparency of the financial product that promotes an environmental objective or respectively promote environmental characteristics in periodic reports. Such measures and penalties shall be effective, proportionate and dissuasive.

ENTRY INTO FORCE

The Taxonomy Regulation enters into force on 20th day following its publication.

- Article 4 (use of criteria for environmentally sustainable economic activities), article 5 (transparency of environmentally sustainable investments), 6 (transparency of financial products), 7 (transparency of other financial produces), 8(1) and 8(2) and 8(3) (transparency of undertakings in non-financial statements) in respect to:

- climate change adaptation and mitigation shall apply as of 1 January 2022;

- sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control and protection and restoration of biodiversity and ecosystems shall apply from 1 January 2023.

- Article 4 shall not apply to certificate-based tax incentive schemes that exist prior to the entry into force of the Taxonomy Regulation and that set out requirements for financial products that aim to finance sustainable projects.

Source: ici