I. Overall situation

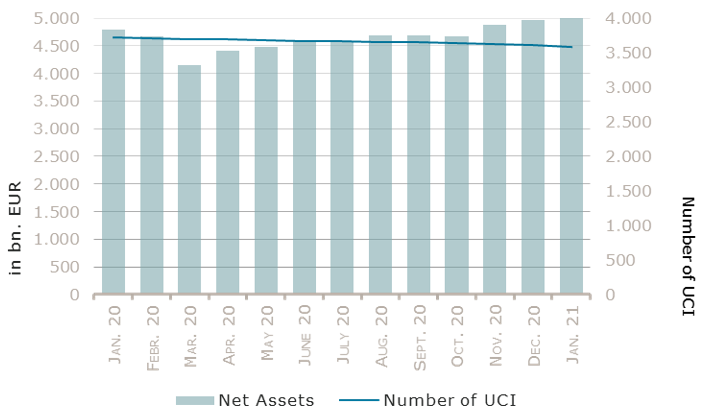

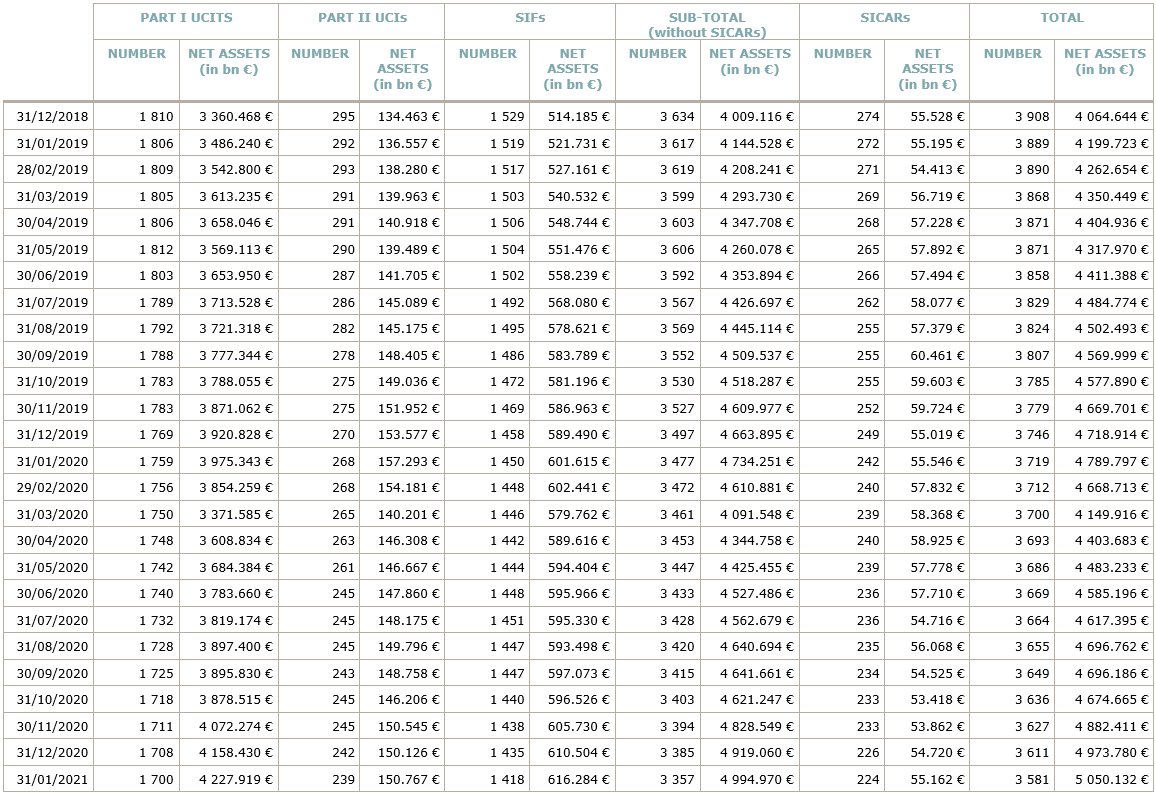

As at 31 January 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,050.132 billion compared to EUR 4,973.780 billion as at 31 December 2020, i.e. an increase of 1.54% over one month. Over the last twelve months, the volume of net assets rose by 5.44%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 76.352 billion in January. This increase represents the sum of positive net capital investments of EUR 41.421 billion (+0.84%) and of the positive development of financial markets amounting to EUR 34.931 billion (+0.70%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,581, against 3,611 the previous month. A total of 2,357 entities adopted an umbrella structure representing 13,371 sub-funds. Adding the 1,224 entities with a traditional UCI structure to that figure, a total of 14,595 fund units were active in the financial centre.

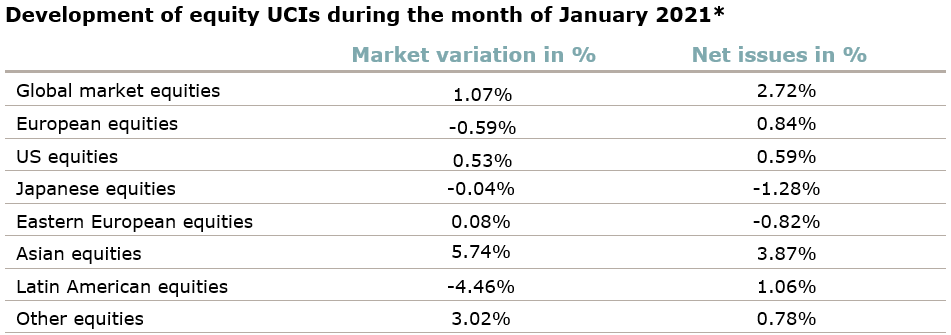

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of January:

Global equity markets registered a divergent development in the context of the extended lockdowns, the vaccine distribution problems and the various fiscal stimulus packages in different regions. Investment grade corporate bonds moved sideways, whereas government yields increased for the month of January.

Concerning developed markets, the European equity UCI category registered a negative performance induced by a slow roll-out of Covid-19 vaccines, the emergence of more infectious virus strains, stricter lockdown measures and worsening economic indicators. Despite the prospect of an extensive economic stimulus package in the United States after the Democratic party secured control of Congress and the beginning mass vaccinations, US equity markets declined mainly due to coordinated speculative movements of a group of retail investors on a relatively small number of stocks, resulting in higher market volatility and reduced risk-appetite. The appreciation of the USD against the EUR compensated these losses and shifted the US equity UCI category in positive territory. The Japanese equity UCI category tracked sideways in January amid the perspective of further fiscal stimulus measures, the vaccine roll-out program, the turbulences on US equity markets and rising infection rates in Japan.

As for emerging countries, the Asian equity UCI category rose against the backdrop of improving economic data, the perspective of further fiscal stimulus measures in the US and the more moderate pandemic activity in Asia in comparison to other regions. The Eastern European equity UCI category developed sideways amid rising oil prices on the one hand and a weaker RUB and tensions between Russia and the EU due to the Navalny case on the other hand. The Latin American equity UCI category recorded a decline, driven by profit-taking following a strong fourth quarter 2020 and weaker domestic currencies.

In January, equity UCI categories registered an overall positive net capital investment.

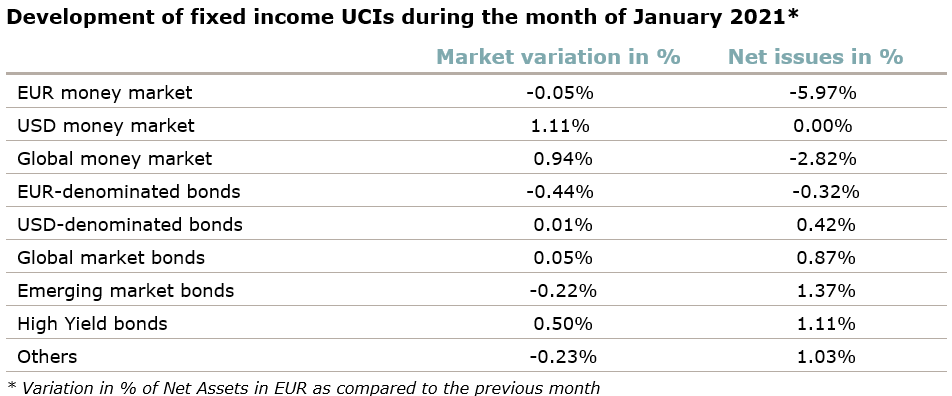

As for EUR-denominated bonds, highly rated government bonds yields increased (i.e. bond prices declined) under the impulse of extended lockdowns in Europe and the slow COVID-19 vaccine rollout while the European Central Bank signalled the continuation of its expansive monetary policy. Against this backdrop, investment grade corporate bonds moved sideways. Overall, the EUR-denominated bond UCI category fell in January.

US government bonds yields increased in January, supported by anticipated fiscal stimulus measures and as a result higher public debt and inflation, the relatively good vaccination progress in the US and falling infection rates. The appreciation of the USD against the EUR compensated for the rising yields and as a result the USD-denominated bond UCI category tracked sideways.

The Emerging market bond UCI category saw a slightly negative performance in the context of rising US government bond yields, higher inflation expectations in the wake of improving economic prospects and a divergent evolution of emerging market currencies.

In January fixed income UCI categories registered an overall positive net capital investment. The largest outflows were recorded in the EUR money market UCI category.

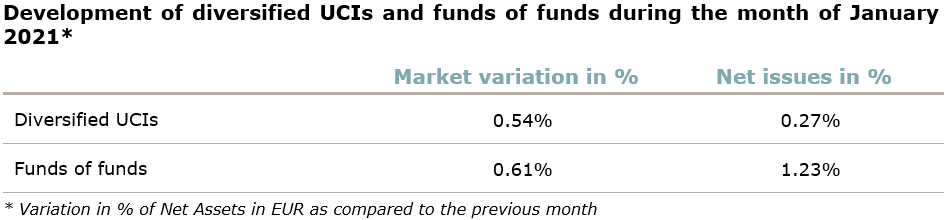

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following six undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- GLOBAL CREDIT SUSTAINABLE, 308, route d’Esch, L-1471 Luxembourg

- M&G (LUX) INVESTMENT FUNDS 2 FCP, 16, boulevard Royal, L-2449 Luxembourg

SIFs:

- CATALYST CORE PLUS EUROPEAN PROPERTY FUND, 42-44, avenue de la Gare, L-1610 Luxembourg

- DEKA ALTERNATIVE INVESTMENTS REX, 6, rue Lou Hemmer, L-1748 Findel

- GAAM FIRMENINVEST, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- YIELCO INFRASTRUKTUR III S.C.S. SICAV-SIF, 9A, rue Gabriel Lippmann, L-5365 Munsbach

The following thirty-six undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ANSA – GLOBAL Q MACRO L/S, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- BANK OF CHINA INTERNATIONAL (BOCI) COMMERZBANK, 22, boulevard Royal, L-2449 Luxembourg

- DEKA-LIQUID ALTERNATIVE STRATEGIES, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- LIAM WERTSICHERUNGSFONDS PLUS, 22, boulevard Royal, L-2449 Luxembourg

- LOGIINVEST, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- LOYS EUROPA, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- MUNDUS CLASSIC VALUE, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- SEB SICAV 3, 4, rue Peternelchen, L-2370 Howald

- UBS (LUX) MEDIUM TERM BOND FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- VB KARLSRUHE PREMIUM INVEST, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

UCIs Part II 2010 Law:

- ABSOLUTE RETURN STRATEGY SICAV, 88, Grand-Rue, L-1660 Luxembourg

- ALL PROPERTIES, 17, rue de Flaxweiler, L-6776 Grevenmacher

- TREETOP PORTFOLIO SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

SIFs:

- ALFA CAPITAL LUXEMBOURG SA, SICAV-FIS, 42, rue de la Vallée, L-2661 Luxembourg

- ALLIANCEBERNSTEIN ALLOCATIONS, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ARES STRATEGIC INVESTMENT PARTNERS IV, 2, rue Jean Monnet, L-2180 Luxembourg

- AXA ACTIVE PROTECTION, 49, avenue J-F Kennedy, L-1855 Luxembourg

- BANK CAPITAL OPPORTUNITY FEEDER FUND SICAV-SIF, 47, avenue J-F Kennedy, L-1855 Luxembourg

- BENTALL KENNEDY LUXEMBOURG FUNDS SCSP, SICAV-FIS, 5, rue Heienhaff, L-1736 Senningerberg

- CLUSTER S.C.A., SICAV-SIF, 3, rue Jean Piret, L-2350 Luxembourg

- CROWN PREMIUM PRIVATE EQUITY III SICAV, 9, allée Scheffer, L-2520 Luxembourg

- DUEMME PRESTIGE, 60, avenue J-F Kennedy, L-1855 Luxembourg

- FAP FEEDER FUND SCA, SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- FAST FIVE, 18, boulevard Royal, L-2449 Luxembourg

- FONDS DE PENSION – DEPUTES AU PARLEMENT EUROPEEN SICAV-FIS, 5, allée Scheffer, L-2520 Luxembourg

- GLL BVK OPPORTUNITIES SCS SICAV-FIS, 15, rue Bender, L-1229 Luxembourg

- GOLDING MEZZANINE SICAV III, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- GOLDING MEZZANINE SICAV IV, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- IBC LENDING FUND SCSP SICAV-SIF, 121, avenue de la Faïencerie, L-1511 Luxembourg

- KAG INVESTMENTS FUND SICAV-FIS, 94, rue du Grünewald, L-1912 Luxembourg

- MAVIN PROPERTY FUND, 42-44, avenue de la Gare, L-1610 Luxembourg

- MOMENTUM MANAGED FUNDS SICAV-SIF, 6H, route de Trèves, L-2633 Senningerberg

- MYTHOLOGY EUROPEAN REAL ESTATE FUND S.C.A, SICAV-SIF, 6, rue Eugène Ruppert, L-2453 Luxembourg

- UOI REAL ESTATE SICAV-SIF, 6A, rue Gabriel Lippmann, L-5365 Munsbach

SICARs:

- COREPLUS II DIVERSIFIED FEEDER, SICAR S.C.A., 412F, route d’Esch, L-1030 Luxembourg

- OXO CEE ANGEL SCSP SICAR, 2, avenue du Blues, L-4368 Belvaux