1. Executive summary

The COVID-19 pandemic has hit Luxembourg as other European countries since the beginning of the year 2020 and has adversely affected a number of issuers under our supervision. In this context, we have decided to carry out a thematic review of the information provided by issuers concerning the impact of COVID-19 on their operations and financial performance as of 30 June 2020.

We noted that information provided in the interim financial reports regarding the effects of the COVID-19 pandemic was generally sufficiently entity-specific and detailed. The information was mainly available in the management reports and often repeated or summarized in the relevant notes to the financial statements.

However we consider that there are several areas for improvement that issuers should consider when preparing their future financial information regarding the impacts of this pandemic.

The main issue encountered concerns the impairment of non-financial assets. Indeed we were confronted with insufficient disclosure in the interim financial reports and more importantly, we observed that the assessments made by management with regard to the recoverable value of non-financial assets did not always appear consistent with the impacts of the COVID-19 pandemic (on the first half-year 2020 and planned) described elsewhere in the financial reports.

Another area for improvement concerns the measurement and disclosure of expected credit losses (ECLs), especially on trade and lease receivables for corporates. A number of the issuers examined hold significant receivables for which the credit risk is likely to change as their clients could be weakened by the effects of COVID-19. As such, we expect issuers to provide precise information on their credit risk management in response to COVID-19 and on any significant adjustments made to the impairment models as well as on the impairment losses recognised.

The findings detailed below relate to interim and annual financial reports published for periods ending March 2020 or after. The purpose of this document is to assist issuers in preparing their next interim or annual financial report.

2. Scope and methodology of the review

We selected for our thematic review the interim financial reports as at 30 June 2020 or the annual financial reports for period ending March 2020 for 16 issuers. These reports were prepared in accordance with IFRS.

Issuers included in the sample are those for which we determined that the COVID-19 outbreak had a significant effect on the first half-year 2020, based on several criteria (sectors at risk; drop in market capitalisation; decrease in revenues, net income or other financial performance measures explained by COVID-19; guidance / outlook for full-year 2020 withdrawn or negatively updated).

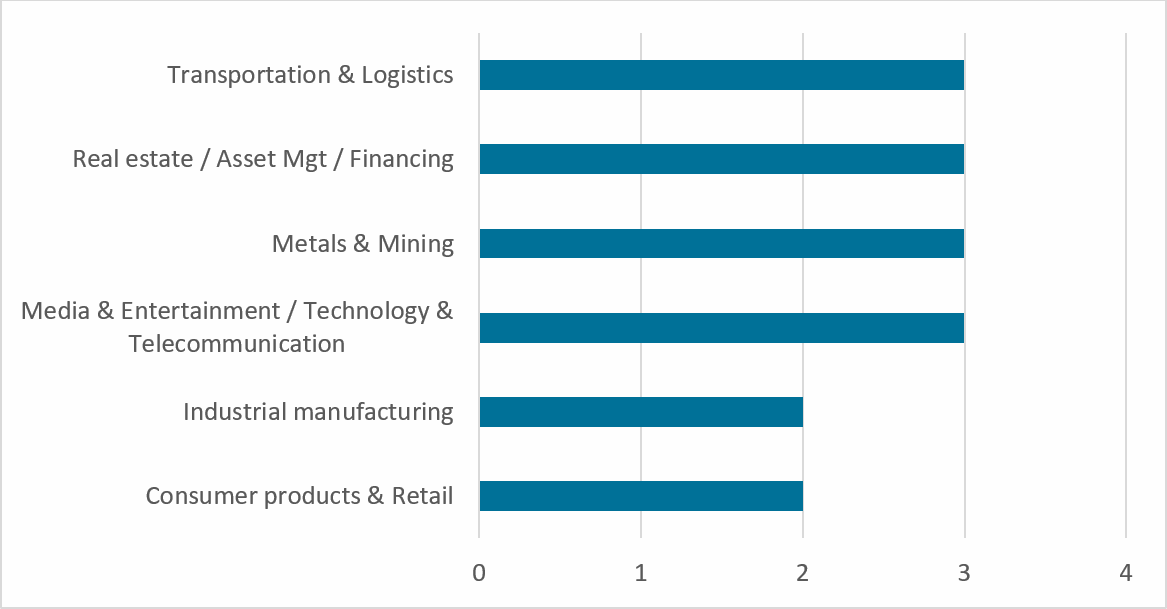

Industries represented in the sample are as follows:

The topics reviewed were notably those identified in the ESMA public statement on implications of the COVID-19 outbreak on the half-yearly financial reports (ESMA Public Statement 1), in particular:

Disclosures reflecting significant uncertainties, going concern and risks linked to COVID-19;

Change in credit risk and impact on expected credit losses;

Impairment of non-financial assets;

Disclosure requirements related to the application of relief and support measures granted by public authorities;

Presentation of COVID-19 related items in the primary statements;

Management reports and alternative performance measures (APMs).

3. Key findings

3.1 Disclosures reflecting significant uncertainties, going concern and risks related to COVID-19

Going concern

Approximately half of the financial reports reviewed contained a statement on the issuer’s ability to continue as a going concern in light of the COVID-19 outbreak, whereas none of them disclosed material uncertainties that cast significant doubt on the going concern assumption.

When management is aware, in assessing its ability to continue as a going concern, of material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern, the entity shall disclose those uncertainties. (IAS 1.25)

Given the current uncertain environment, marked by a strengthening of the pandemic in Europe, we expect issuers to enhance their disclosures regarding going concern in their future financial reports, by clearly indicating whether there are any material uncertainties likely to arise and explaining the key assumptions and judgements.

Liquidity risk

We were satisfied to note that most financial reports reviewed included qualitative and quantitative descriptions of the liquidity and funding situation of the issuer, along with key actions undertaken to secure its liquidity when relevant.

However, only a few companies provided detailed information regarding compliance with their debt covenants.

ESMA recommends that issuers provide detailed and entity specific information on the issuer’s liquidity position and its liquidity risk management strategy (ESMA Public Statement).

As the situation evolves rapidly, we expect issuers to disclose detailed and updated information on their liquidity situation and its expected evolution in their future financial reports. Moreover, we recommend that issuers improve disclosure by providing quantitative information on covenants, even when they comply with their requirements.

3.2 Change in credit risk and impact on expected credit losses (ECL)

We could not find specific information in the 2020 interim financial reports reviewed in relation to the calculation of ECLs in accordance with IFRS 9 Financial Instruments nor disclosures to explain the assumptions and judgements applied due to the fact that IAS 34 Interim Financial Statements does not contain any specific requirements in that respect. However, given the COVID-19 pervasive impacts on the European economy, we believe that the assumptions and judgements applied in determining ECLs should certainly have evolved since the previous year-end.

However, even for issuers with very significant trade receivables and contract assets, disclosure related to credit risk was often boilerplate and unhelpful, thus not allowing for a clear understanding of issuers’ assessment and measurement of ECLs.

We expect issuers to explain changes to their credit risk management in response to the COVID-19 pandemic and to disclose any significant adjustments made to the impairment figures and models as well as key sources of estimation uncertainty in their future financial reports.

3.3 Impairment of non-financial assets

Indication of impairment

With very few exceptions, issuers reviewed considered that the COVID-19 pandemic was an indicator of impairment and therefore have performed an impairment test on non-financial assets at risk as at 30 June 2020.

However, for some issuers, it was unclear which assets were tested for impairment and which were not, and the reason for not selecting certain assets.

An entity shall assess at the end of each reporting period whether there is any indication that an asset may be impaired. If any such indication exists, the entity shall estimate the recoverable amount of the asset. (IAS 36.9)

As part of the impairment testing of non-financial assets with definite useful life in the preparation of their future annual financial reports, we expect issuers’ assessment of an indication of impairment to be consistent with their analysis of the impacts of the COVID-19 pandemic in the financial report and that this assessment is clearly explained. Intangible assets with an indefinite useful life must be tested for impairment annually, regardless of any indication of impairment.

Impairment test assumptions

In the financial reports examined, there was a wide disparity in the information given concerning the financial and operational assumptions used when performing impairment tests. Some issuers provided extensive information, including quantitatively, on the key assumptions used and their changes since the last annual impairment test and explained the scenario envisaged, sometimes considering multiple scenarios.

On the other hand, others provided few or no information about key assumptions. For instance, one issuer stated that “tests have been performed in line with the methodology used for the annual impairment tests using Group’s latest forecasts” but did not disclose the extent to which the “latest forecasts” were taking into account the expected impacts of COVID-19. Another disclosed that it “reviewed its business plan and the discount rates used to perform the impairment tests” without provided any furthers details.

While IAS 34 does not require issuers to provide the detailed disclosures required by IAS 36 Impairment of assets, such information is at least encouraged by paragraphs 5 and 15ss.

(IAS 36.134d) If the unit’s recoverable amount is based on value in use, an entity shall disclose, among others:

each key assumption on which management has based its cash flow projections and a description of management’s approach to determining the value(s) assigned to each key assumption,

the period over which management has projected cash flows based on financial budgets/forecasts,

the long-term growth rate used and the discount rate(s) applied to the cash flow projections.

We expect issuers to provide, in their future financial reports, clear disclosures about how they have incorporated COVID-19 risks into their cash flow projections, discount rates and long-term growth rates. Use of multiple scenarios is encouraged in order to better assess the recoverable values despite the uncertainties related to the COVID-19 pandemic.

Sensitivity analysis

Again, the quality of disclosures regarding the sensitivity analysis was very diverse. Good disclosures indicated the amount of headroom and explained by which level, on their own or together, reasonably possible changes in key assumptions would lead to an impairment. They also indicated which change in key assumptions would result in the estimated recoverable amount being equal to the carrying amount of the assets tested.

But most disclosures were regrettably less informative and several issuers did not provide any information on the sensitivity of the key assumptions used in the impairment test, as it is not a specific requirement in IAS 34.

If a reasonably possible change in a key assumption would result in an impairment loss, an entity is required to disclose the amount by which the recoverable amount exceeds the carrying amount, the value assigned to the key assumption, and the amount by which the value assigned to the key assumption must change in order for recoverable amount to be equal to its carrying amount. (IAS 36.134f)

When preparing their future financial reports, we expect issuers to disclose the sensitivity analysis as required by IAS 36 and to take into account that, due to the current uncertain environment, the range of reasonably possible changes in key assumptions may be rather wide.

3.4 Other findings

Disclosure requirements related to the application of relief and support measures granted by public authorities

We noted very few disclosures on the various relief and support measures that issuers may have recourse to, their conditions of eligibility and their consequences. However we cannot conclude with certainty whether these measures were relevant for the issuers reviewed or not.

We remind issuers that, where applicable, they should consider the relevant disclosure requirements in the individual IFRSs based on which such measures are accounted for. In particular, they need to explain the accounting policy choices made in accordance with IAS 20 Accounting for Government Grants and Disclosure of Government Assistance.

Presentation of COVID-19 related items in the primary statements

No issuer reviewed included specific subtotals in the profit or loss to depict the impact of the COVID-19 pandemic. Several issuers reviewed have added a specific note in relation to COVID-19 effects, including key assumptions, judgements and estimates made and quantitative information on the financial performance, which we have found particularly useful.

For their future financial reports, we expect issuers to continue to follow the same approach to disclose the impact of the COVID-19 pandemic by explaining it the notes to their financial statements. Indeed, in line with ESMA Public Statement, we consider that any separate presentation of such impact in the statement of profit or loss could be misleading to users of the financial statements.

Management reports and APMs

We generally observed useful qualitative and quantitative information disclosed in the management report regarding the impacts of the COVID-19 pandemic on the operations, financial performance, strategy and outlook of the companies reviewed.

We encourage issuers to enhance management reports by also providing information on measures taken to address or mitigate the impacts of the COVID-19 pandemic on their operations and performance and the progress/state of completion of such measures to date.

We noted that the issuers reviewed did not disclose any new APM in relation to COVID-19 and rather added narrative information explaining COVID-19 impacts on their performance.

We consider this to be good practice and highlight that new COVID-19 related APMs would be in most cases inappropriate. In the specific situation where issuers consider the presentation of new APMs as relevant, we remind issuers that they are subject to the principles and disclosure requirements provided for in ESMA’s Guidelines on APMs 2 and notably to the principle of consistency.

4. Next steps

Although we found many good disclosures in relation to COVID-19, we noted several areas for improvement. Examinations are currently ongoing with issuers where the information reviewed was not considered clear enough for us to ensure that the effects of the COVID-19 pandemic have been adequately taken into account in the financial statements.

While the COVID-19 pandemic continues to strongly affect European economies, we encourage issuers to consider carefully the findings and recommendations in this paper and enhance the disclosures in their year-end reports. We notably urge issuers to appropriately disclose significant judgements and estimates made in accounting for the impact of the COVID-19 crisis and the sensitivity of these assumptions to changes.

In the next few weeks, we will release the CSSF priorities in relation to the enforcement of financial information for 2020 financial statements. In that context and along with other priorities for the year, we will focus on the information provided in relation to the effects of the COVID-19 pandemic on the operations, performance, financial position and outlook of issuers.

More information on examinations by the CSSF within the framework of its mission under Article 22 (1) of the Transparency Law is available on the CSSF’s website (Topics > Enforcement of financial information).

1 ESMA32-63-972

2 ESMA/2015/1415en – ESMA Guidelines on Alternative Performance Measures – 05/10/2015